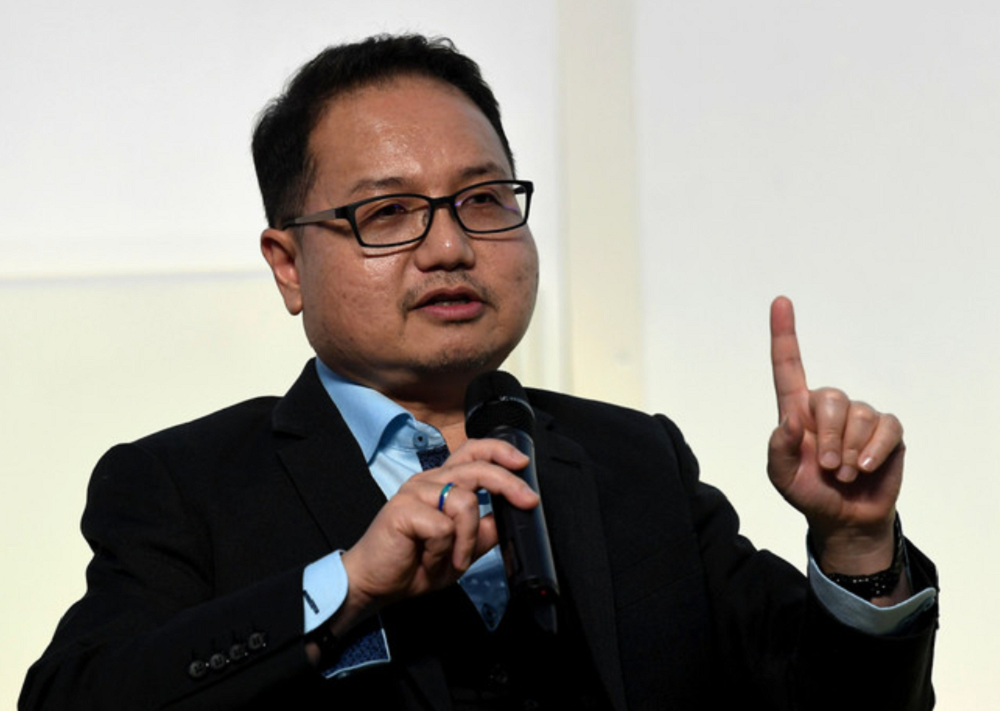

Malaysia Automotive, Robotics and IoT Institute (MARii) CEO Datuk Madani Sahari said the government has prepared an acceleration policy on electric vehicles. — Bernama pic

Subscribe to our Telegram channel for the latest updates on news you need to know.

KUALA LUMPUR, May 19 — Malaysia is ready to offer a handsome tax incentive to accelerate the electric vehicle (EV) development in the country in its soon-to-be announced accelerated EV policy under the National Automotive Policy (NAP) 2020.

Malaysia Automotive, Robotics and IoT Institute (MARii) CEO Datuk Madani Sahari said the government has prepared an acceleration policy on EV.

“Currently, we are implementing customised incentives, depending on your economic benefits, then the incentive will be customised accordingly. But under the new EV accelerated policy, there are fixed incentives.

“There is one part of fixed incentives in terms of the excise duty, import duty and sales tax, in terms of what users and industry is going to enjoy.

“But on top of that, if you are bringing into Malaysia something extraordinary, we are willing to consider even higher level of incentives and that one will be customised exactly to the level that you are bringing into the country,” he said during the webinar session with Eurocham Malaysia’s Automotive Sector Committee on “A New Start for EV In Malaysia” today.

If there are original equipment manufacturers (OEMs) that intend to really make it big into Malaysia, Madani said they can enjoy that level of fixed incentives, which is for everybody, on top of other special incentives that they are going to enjoy.

“In terms of tax incentive (for buyers), the accelerated policy is being finalised and we are looking at expanding the scope of incentive to include users in order for them to enjoy incentives as they buy EVs,” he said.

Madani said users would generally enjoy benefits in terms of direct incentives either in the form of road tax, green parking scheme, charging installation as well as toll rebates.

“This mechanism is in the final approval by the government but apart from that, as far as the industry is concerned, in principle, we are really going for a handsome level of tax exemption, either in the form of a huge tax reduction in terms of excise duty, import duty and sales tax for EVs,” he added.

For the new accelerated policy, Madani said it is hoped that the policy could be brought to the Cabinet by June this year for approval, before announcing it in July.

“The scope of the new policy will include passenger cars, scooters, motorbikes as well as commercial vehicles. It will also include original equipment manufacturers (OEMs), manufacturers of EVs as well as companies that are using EVs as a form of service, such as SoCar and Grab,” he said.

For this time around, Madani said MARii is very specific in terms of policy and the association has catered for and facilitated the needs from various angles and these are really the broad angles of supply and demand to enhance the EV ecosystem in the country.

He said under the accelerated policy, MARii has categorised the next sector to be promoted in Malaysia which is the next generation vehicle, consisting of green vehicles, where EV is one of the dominant sectors.

“The ecosystem within this accelerated policy consists of infrastructure, namely charging, testing and facility, among others.

We also include part of the ecosystem to be incentivised in the new policy in the development of the local technology as well as standard development and talents. — Bernama