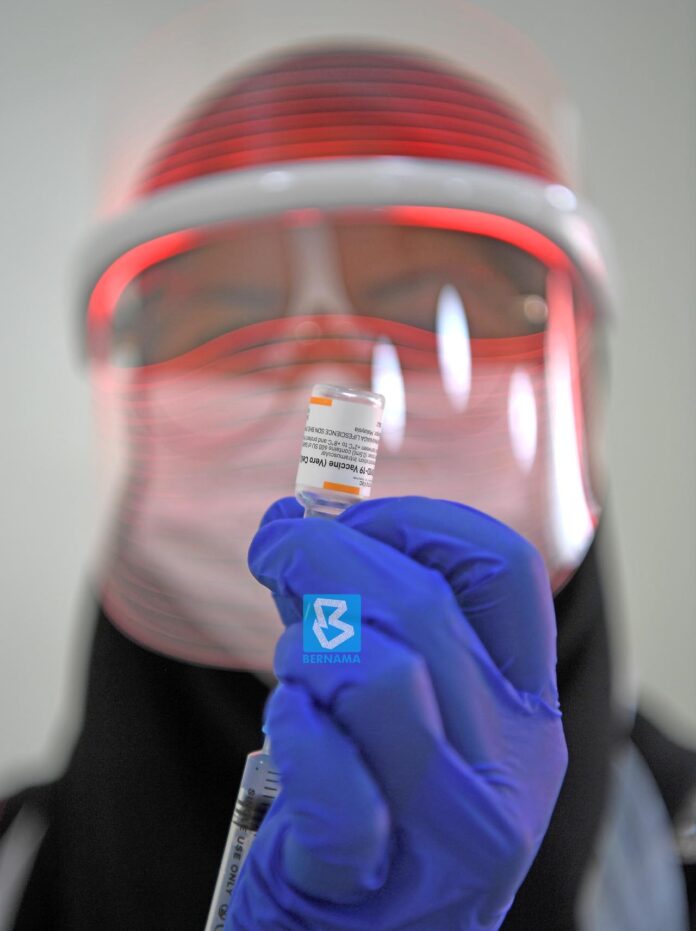

The number of new Covid-19 cases in the US and the European countries have declined drastically since the peak in the first quarter of 2021, leading to a possible decline in demand for rubber gloves. — Bernama photo

KUCHING: Analysts have downgraded their view on the rubber gloves sector to ‘neutral’ as the average selling prices (ASP) of rubber gloves are expected to soften due the diminishing need for rubber gloves as the pandemic is beginning to taper off particularly in developed countries.

“One of the developments that has shifted the urgent demand for rubber gloves is the improving situation of the pandemic in the developed countries.

“The number of new Covid-19 cases in the US and the European countries have declined drastically since the peak in the first quarter of 2021 (1Q21). On top of that, the Covid-19 vaccination programs in the developed countries continue to accelerate,” MIDF Amanah Investment Bank Bhd’s research team (MIDF Research) highlighted in a sector update report.

Based on channel its checks, it noted that glove makers have lower spot allocation compared to one to two quarters ago. Some are focusing solely on contractual orders.

It also pointed out that pricing for contract orders are softening at a gradual rate as a result of the ever-changing demand and supply dynamic.

“One of the factors is buyers adopting a wait-and-see approach as they try to reduce their risk of holding high-price inventory.

“Although we expect prices to stay above pre-pandemic level, we opine that as the urgency for gloves subsides, ASP for gloves are likely to tilt lower,” it said.

It also pointed out that in 2021, companies continue to add in new production lines to churn out more gloves and the estimated new supply, contributed by existing players and new setups, is estimated to increase by more than 30 per cent compared to the previous year.

“The higher capacity has also contributed to the easing in demand for urgent orders. That said, we expect demand for gloves to remain strong but the dwindling urgent requirement for rubber gloves is likely to tone down high ASPs.

“In fact, demand for gloves is expected to continue to outstrip supply into 2022. The tide is anticipated to turn in 2023,” it opined.

While raw material prices are expected to ration with incoming supply, average prices are still higher year-on-year. Coupled with the weaker ASP trend, MIDF Research expect profit margin to narrow.

On average, MIDF Research reduced its 2022 and 2023 ASP assumption by five to 10 per cent.

“We are now ‘neutral’ on the sector as we think that the upcycle of the sector is coming to a tail end. As such, we believe that profitability is likely to normalise in tandem with the lower ASP.

“That said, the demand for gloves is likely to remain healthy due to higher hygiene awareness and better healthcare practices. The glove companies are also in a good position to defend their market share given their healthy cashflow, sturdy balance sheet and investment into new facilities as well as research and development,” MIDF Research said.