Maybank unveils its all-new Maybank2u Biz app to help empower SMEs. — Picture courtesy of Maybank

KUALA LUMPUR, Nov 1 — The digital transformation continues to drive change in businesses regardless of their size.

With increased technological advancements, businesses today look for banking services that offer unprecedented speed, new levels of convenience and tailored tools.

To meet such demands, Malayan Banking Berhad (Maybank) has unveiled an all-new smarter and more secure business banking mobile application to simplify small and medium enterprises’ (SMEs) day-to-day banking activities.

Dubbed Maybank2u Biz app, the application is equipped with tools to ease business operations on the go.

The new app aims to complement the existing Maybank2u Biz web edition by providing a full mobile experience for them.

To kick-off and enjoy the perks, SMEs must sign up for a Maybank Business Account and choose Maybank2u Biz as their digital banking method.

Designed with simplicity in mind, the app promises to be a business companion to help empower SMEs to drive their businesses forward.

It simply offers SMEs the freedom to manage finances at their fingertips.

The app allows access of up to five users per business with three types of roles such as Maker, Checker and Viewer.

With such options, businesses can select their respective representatives to initiate, approve and check transactions.

Here’s what you can expect from the Maybank2u Biz app:

The simplified accounts overview feature helps businesses to keep track of assets and liabilities. — Picture courtesy of Maybank

Simplified accounts overview

It is imperative to check your business account overview daily to find and fix issues such as cash flow and inventory discrepancies.

But without proper tools and platforms, receipts, sales orders and financial statements would pile up – causing you to lose sight of important data that may affect the financial health of your business.

To help SMEs to stay on top of their assets and liabilities, the app provides a simplified accounts overview for better cash flow decisions.

You will get to keep track of your assets, consisting of accounts, fixed deposits as well as liabilities such as hire purchases and loans right from the dashboard.

The users may also export up to one year’s worth of financial data to integrate it with current bookkeeping and accounting systems.

Maybank2u Biz app offers seamless transactions on the go to help businesses make payments at any time and everywhere. — Picture courtesy of Maybank

Transaction on the go

Many SMEs today require a payment mechanism that is fast and seamless, especially when they are on the go or work in a fast-paced setting.

The easiest way to carry out transactions on the go would be through mobile.

Thanks to the Maybank2u Biz app, you can initiate and approve payments and fund transfers at any time and anywhere.

To speed things up, you can set recurring payments and favourite payees for automated payment.

The account checkers can also enjoy the convenience of approving up to 10 transactions at one go with a seven-day approval period.

The built-in invoicing tool helps businesses saves time and paperwork. — Picture courtesy of Maybank

Built-in invoicing tools

Proper and consistent invoicing is a vital part of running a business as it encourages systematic cash flow.

The Maybank2u Biz app comes with built-in invoicing tools to help businesses save time and paperwork.

Simply customise your invoices from the ready-to-use templates within the app and send them directly to your clients via email or WhatsApp.

Once the invoice is ready, you may review it and tap on submit for approval.

The invoice will then be queued for the checker’s approval.

Once approved, you may monitor the status of the payment and even send a reminder with a templated email provided in the app.

For the invoices that are paid, you may choose to issue a receipt to your clients using the app.

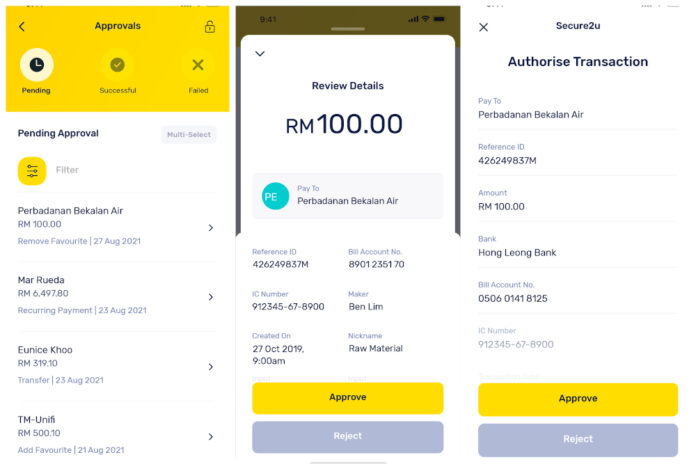

Secure2u feature ensures your business is safe from fraud. — Picture courtesy of Maybank

Increased security with Secure2u

The application has also tightened its security measures to avoid instances of fraud as it requires approvals only from registered devices.

The Secure2u feature pairs your Maybank2u Biz account with your device, only allowing transactions that are authorised on your registered device.

The measures are put in place to reduce your exposure to SMS TAC (transaction authorisation code) fraud and the need to rely on telco networks for SMS.

To kick off the new application, Maybank has rolled out the Power2Win campaign with cash rewards of up to RM30,000 for all Maybank2u Biz users.

All you have to do is to download the Maybank2u Biz app and stand a chance to be one of the 10 lucky winners every month.

The campaign will run until December 31.

Surf over here for more info about the Maybank2u Biz app.

Maybank2u Biz customers may download the app from the Google Play Store or Apple App Store, while existing Maybank Business Customers can sign up to M2U Biz over here.

Those who are new to Maybank Business may sign up for an account over here.