Datuk Seri Najib Razak is pictured at Kuala Lumpur High court November 11, 2021. — Picture by Ahmad Zamzahuri

KUALA LUMPUR, Nov 11 — Former finance minister Datuk Seri Najib Razak had in 2013 signed off a crucial letter of support that was seen as guaranteeing and enabling a US$3 billion debt to be taken on by a 1Malaysia Development Berhad (1MDB) subsidiary, despite concerns raised by the Finance Ministry over such a document, a witness told the High Court today.

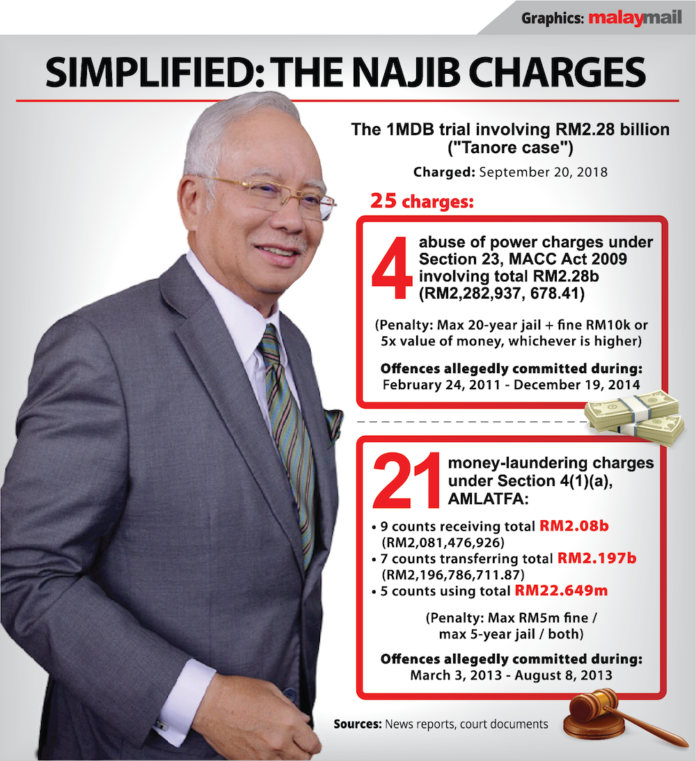

Azmi Tahir, the former chief financial officer of 1MDB, was testifying as the 12th prosecution witness in a trial where Najib is facing 25 charges over more than RM2 billion of funds allegedly misappropriated from 1MDB.

Azmi said the fundraising process by 1MDB Global Investments Limited for the US$3 billion was carried out hastily, as Najib’s alleged 1MDB adviser Low Taek Jho had instructed for the fundraising to be sped up for a planned joint venture between 1MDB and Aabar Investments PJS.

The joint venture was touted as a government-to-government deal between Malaysia and Abu Dhabi, although it is now known that 1MDB had instead dealt with a fake company that had similar names to the Abu Dhabi-based Aabar Investments PJS.

Najib signs letter of support

Azmi today verified in court a letter of support signed by Najib as finance minister on March 14, 2013 to represent the Malaysian government in supporting 1MDB Global Investments Ltd (1MDB GIL) in issuing the US$3 billion bond.

Although it was not issued in the form of a government guarantee, Azmi said the effect was the same.

“However, although it was issued in the form of a letter of support, it still places the responsibility and commitment from the Malaysian government if 1MDB fails to make repayments to service the debt for the issuance of the US$3 billion bond,” he told the court today.

“This letter of support is the source of authorisation for the approval for the US$3 billion bond issuance by 1MDB GIL, as without the Malaysian government’s guarantee, the bank would certainly not allow the bond issuance to be done by 1MDB or even 1MDB GIL, which did not have strong financial sources and cashflow,” he added.

Azmi also pointed out that he had also attended several meetings where MOF’s own solicitor or the then Treasury solicitor Toh Puan Azian Mohd Aziz had shown she disagreed with the proposed letter of support, due to her concerns that the government would have to bear the debt by 1MDB and 1MDB GIL.

“However, in the end, Datuk Seri Najib had approved this letter of support by signing it in a short time,” Azmi said, adding that this was in line with Low allegedly telling 1MDB officials that Najib would approve it and that they need not worry about his approval.

1MDB GIL, which was set up as a special purpose vehicle for the US$3 billion fundraising, was a company newly formed just about a week before on March 8, 2013 in the British Virgin Islands.

How a letter of comfort became a letter of support for US$3b debt

Azmi said Low had from early on proposed for the Finance Ministry to issue a letter of comfort to guarantee the issuance of a bond to raise the funds — initially mooted to be US$6 billion but finally becoming US$3 billion — and that Low’s alleged proxy and 1MDB general counsel Jasmine Loo was negotiating with Goldman Sachs’ Tim Leissner on the matter.

During a January 23, 2013 meeting at the Finance Ministry attended by various individuals such as the ministry’s officials and 1MDB officials Azmi, Loo and Azmi’s deputy Terence Geh, a presentation was made by Leissner on the proposed joint venture with 1MDB and Aabar to both pump in US$3 billion each and with Goldman Sachs allegedly proposed by Abu Dhabi’s crown prince to help arrange the bonds issuance, Azmi said.

Azmi said, however, that the Finance Ministry had objected to the contents of a proposed draft of the letter of comfort which Leissner had prepared.

Azmi said that Loo later on January 30, 2013 told him that 1MDB had again met with the Finance Ministry where the ministry was told that the proposed letter of comfort would not be able to attract investors, and that Goldman Sachs which had attended the meeting had proposed that the letter of comfort be changed into a letter of support with a change in several terms that would further strengthen the government’s support.

Azmi said he received information from Low that the then Treasury secretary-general Tan Sri Mohd Irwar Serigar Abdullah would have the role of ensuring that the Finance Ministry agreed to issue the letter of support, adding that what Low said ahead of a meeting — on March 4, 2013 attended by various persons including 1MDB officials such as Azmi, Loo and 1MDB’s financial adviser for the bond Leissner — did happen at the meeting.

In the March 4, 2013 meeting chaired by Irwan, Azmi noted that Irwan had said the joint venture was the prime minister’s own wish as it involves two country’s interests and that the prime minister wants it to be expedited to ensure good bilateral relations.

What happened to the US$3b?

After Najib’s March 14 letter of support and the 1MDB board’s March 12 resolution and March 12 resolution by MOF Inc-owned 1MDB’s shareholder as signed by finance minister Najib, the 10-year bond of US$3 billion was issued by 1MDB GIL on March 19, 2013 with a 4.4 per cent interest on the US$3 billion sum to be paid until 2023.

After accounting for hundreds of millions in dollars of fees payable to Goldman Sachs for arranging the bond issuance, 1MDB GIL eventually received only US$2.721 billion on March 19, 2013.

The purported joint venture company, Malaysian Abu Dhabi Investment Company, was registered in the British Virgin Islands on March 5, 2013, and later renamed Abu Dhabi Malaysia Investment Company (Admic) on March 12, 2013. Initially fully-owned by 1MDB, it was then co-owned by 1MDB GIL and Aabar from October 8, 2013 onwards with both holding a share each.

Azmi said today, however, that the joint venture failed to materialise as Aabar did not inject its share of the US$3 billion, also pointing out that the US$3 billion which 1MDB GIL had hastily raised on March 19, 2013 never made it into the joint venture company Admic.

Azmi said that he was instead directed to put funds from the US$3 billion raised into purported investments and that some of the funds were also used for other purposes that had nothing to do with the alleged Aabar-1MDB joint venture.

“As CFO, the main purpose of the US$3 billion fundraising is for the Admic joint venture, but since the funds were used for other purposes as early as 24 hours after the funds were received, I believe that Admic joint venture was something purposely created to ensure that the bond can be issued legitimately,” he said.

Azmi said the Prime Minister’s Department official Datuk Azlin Alias — who in 2014 became Najib’s principal private secretary — had directed him to sign any documents that would be brought by the BSI Bank’s Singapore branch without being told the purpose of such a meeting, adding that he had complied with the instruction as he viewed it to be an order from the Prime Minister’s Office as Azlin worked directly under the prime minister.

“I consider any instructions given by Datuk Azlin as instructions from Datuk Seri Najib as what Datuk Azlin had informed me from the start,” he said.

Azmi said BSI Bank Singapore’s managing director Yak Yew Chee had then on March 20, 2013 met with him to have him sign off on documents to invest close to US$1.6 billion from the US$3 billion fundraising into three fund companies.

Believing Low now to be the “mastermind” with Low’s alleged proxy and Azmi’s deputy Terence Geh having determined the amount of funds to be sent to the three fund companies, Azmi today said that he did not scrutinise the investment documents as they were brought to him in bulk and simultaneously and as Azlin had directed him to sign off all documents that would be given.

The three fund companies were Devonshire Funds Limited, Enterprise Emerging Markets Fund (EEMF), Cistenique Investment Fund, and they are now known to be linked to Low.

Citing documents such as 1MDB GIL’s account statement, Azmi said a total of US$1,590,909,099 were transferred from 1MDB GIL to the three companies, with the investments made in multiple portions with Devonshire receiving a total of US$646,464,649, EEMF receiving a total of US$414,141,416 and Cistenique receiving a total of US$530,303,034.

Azmi claimed that he was not able to count the total of funds purportedly “invested” when signing the investment-related agreements by BSI Bank, saying that the investments were structured and the total value was not discussed with him and was done between Geh and the bank.

With the US$1.59 billion all transferred on March 20, 2013 to the three fund companies just one day after the US$2.7 billion funds raised from the US$3 billion bonds were placed into 1MDB GIL, Azmi said this shows a pre-planned move and haste by Geh and BSI Bank to move the money to the three fund companies.

Claiming to have been shut out from accessing further information on the investments subsequently after 1MDB GIL transferred the money out and as BSI Bank was the fund manager, Azmi said he did not know the three fund companies would later transfer funds obtained from 1MDB GIL’s US$3 billion fundraising into two other companies known as Granton Property Holding and Tanore Finance Corporation. The latter two companies are now known to be under Low’s associate Eric Tan’s control.

The prosecution had on the first day of Najib’s trial said it would show that 1MDB GIL had on March 19, 2013 only received US$2.721 billion of the US$3 billion funds it raised with the balance paid to arranger Goldman Sachs as fees, and that over US$1 billion of the US$2.721 billion was paid to the two funds Devonshire and EEMF on March 20 and March 21, 2013.

The prosecution had also said it would show that a total of US$890 million — including a US$430 million sum passing through Granton — made its way within days from Devonshire and EEMF to Tanore, and that it would also showed that Tanore had by early April 2013 transferred US$681 or over RM2 billion to Najib’s account.

Today, Azmi said the transfer of funds from the three purported investment funds to Granton, Tanore and Midhurst Trading Limited were all done without his knowledge, noting that the investment statements that he had received did not contain such names and that he was only familiar with the names of the original three fund companies Devonshire, EEMF and Cistenique as shown in statements of investment accounts.

“I also never allowed any third party to make any investments in others including to individual accounts, namely Datuk Seri Najib’s private account. I am not involved in arranging and transferring funds through this investment fund,” he said.

Azmi said that when Tanore’s name had first appeared in the news and was linked to 1MDB, he had asked Geh if 1MDB had any investments or cooperation with the company but said Geh had denied such matters.

Najib’s trial before High Court judge Datuk Collin Lawrence Sequerah resumes next Monday afternoon, when lead prosecutor Datuk Seri Gopal Sri Ram is expected to re-examine the 10th prosecution witness and former 1MDB CEO Mohd Hazem Abd Rahman.

Azmi is expected to resume testifying next Tuesday.