Datuk Seri Najib Razak is pictured at Kuala Lumpur High court November 11, 2021. — Picture by Ahmad Zamzahuri

KUALA LUMPUR, Nov 16 — The former chief financial officer of 1Malaysia Development Berhad (1MDB) today told the court that he was previously unaware that the government-owned company was actually dealing with and giving money to was a company that was sharing a similar name and same address as the actual Abu Dhabi firm Aabar Investments PJS.

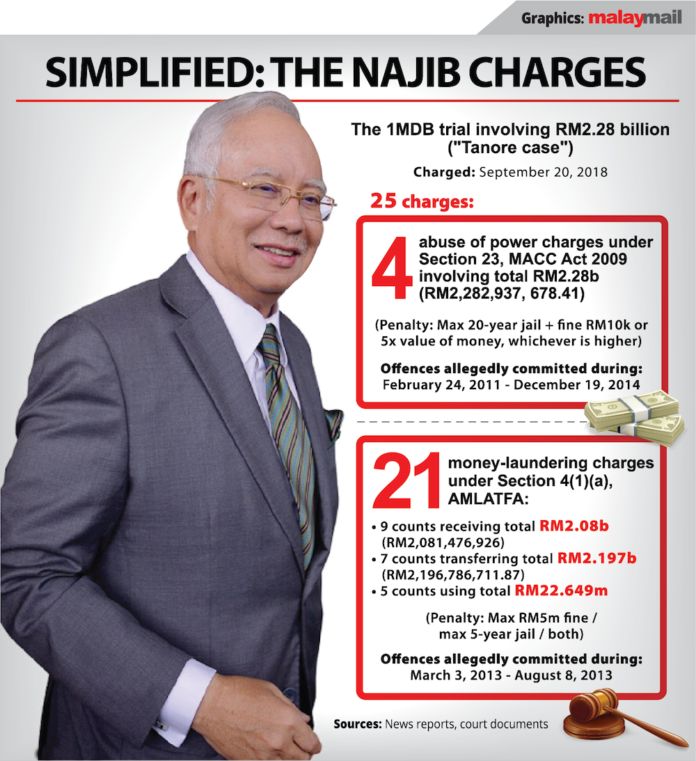

Azmi Tahir was testifying as the 12th prosecution witness in Najib’s trial involving over US$2 billion of funds allegedly misappropriated from 1MDB.

Azmi told the court about a series of convoluted arrangements and transactions that saw hundreds of millions of US dollars from 1MDB subsidiaries flowing out to what is now known to be the fake Aabar. The only difference is that the fake Aabar has an additional word “Limited” at the end.

At the time of the complex deals and transactions however, Azmi said even the 1MDB board did not know of the fake Aabar.

Two separate agreements with fake and real Aabar

For example when speaking about events related to 1MDB raising funds by borrowing from Deutsche Bank in order to buy back share options from Aabar, Azmi said he had not realised that 1MDB subsidiary 1MDB Energy Limited (1MEL) was signing two agreements with two different Aabar companies.

In order to raise funds to buy an independent power plant, 1MEL had taken on debt by issuing a US$1.75 billion bond, with the bond guaranteed by Abu Dhabi’s International Petroleum Investment Company (IPIC).

In exchange for IPIC’s guarantee, 1MEL signed a May 18, 2012 agreement with IPIC subsidiary Aabar Investments PJS to give the latter an option or the right to buy over 49 per cent of shares at RM1.225 billion at any point in time within 10 years from the bond issuance.

Separately, 1MEL signed a May 21, 2012 agreement with IPIC’s purported subsidiary Aabar Investments PJS Limited (now known to be a fake firm), regarding the payment of money to Aabar as collateral deposit in return for Aabar helping to secure the IPIC guarantee of the US$1.75 billion bond.

“I never knew before this that there is a difference between the names of the two Aabar. Even the 1MDB board of directors and management also did not notice this difference.

“This is because the two agreements — Option Agreement and Collaboration for Credit Enhancement — used the same company address for the two Aabar names. Besides that, both Aabar were represented by the same person which is Al-Husseiny,” Azmi said, referring to the real Aabar’s CEO Mohamed Badawy Al-Husseiny.

Previously, former 1MDB CEO Datuk Shahrol Azral Ibrahim Halmi had also said he did not realise that there was a difference between the two Aabar when he signed the May 21, 2012 agreement for the collateral deposit or security deposit from 1MEL to Aabar, due to similarities such as the office address and the agreement using “Aabar Investments” as the short form for the company’s name.

On May 22, 2012 when part of the money raised from the US$1.75 billion bonds came into 1MEL’s Falcon Bank account in Hong Kong, the almost US$577 million was transferred out on the same day to the fake Aabar’s BSI account in Lugano, Switzerland.

In and out on the same day, again

Today, Azmi also spoke of a similar situation involving a separate 1MDB unit called 1MDB Energy (Langat) Limited (1MELL), which had signed an October 17, 2012 agreement with the real Aabar to give the latter the option to buy a 49 per cent stake at RM862.4 million within a 10-year period of a separate US$1.75 billion bond issuance to buy over power plant assets.

Just like 1MEL in May 2012, 1MELL too had signed an October 19, 2012 agreement with the fake Aabar to pay a collateral deposit or security deposit to the fake Aabar in return for IPIC’s guarantee.

Azmi said the 1MDB board, management, and himself did not know that there were two Aabar involved in the October 2012 agreements signed by 1MELL, due to the same details being given for the two Aabar companies.

After successfully raising funds of US$1.75 billion on October 19, 2012, a US$790,354,855 sum (US$790 million) was swiftly transferred out from 1MELL’s account in Falcon Bank to the fake Aabar as a security deposit. (This US$790 million was 45 per cent or almost half of the US$1.75 billion raised by 1MELL.)

Auditor-general’s department asks about Aabar

Azmi said the National Audit Department had started raising this issue regarding Aabar in 2015 when it was carrying out an audit on 1MDB around 2015, adding that he had then asked 1MBD deputy chief financial officer Terence Geh Choh Heng. (Geh is now however a fugitive wanted in Malaysia and is said to be fellow fugitive Low Taek Jho’s associate.)

“I asked about this to Terence Geh and he confirmed that both Aabar is owned by IPIC. He also showed me an incumbency document that showed Aabar Investments PJS Limited is owned by IPIC.

“As far as I know, that incumbency document was submitted by Terence Geh to the National Audit Department. So I did not see any problem at that time until I was asked to provide statements to the authorities starting from 2015,” he said.

Do you know these four individuals? — Picture courtesy of MACC

1MDB bleeds out US$856m to two fake Aabar

Later in September 2012 when 1MDB Energy Holdings Limited was established by renaming a dormant company and when it opened a bank account in Falcon Private Bank Limited, Azmi said he did not know at that time that this bank had any connections to Aabar or Abu Dhabi.

“In 2015, while visiting Abu Dhabi, only then I knew that Aabar through Mohamed Badawy Al-Husseiny is one of the directors to Falcon Bank,” Azmi said.

Previously, the High Court had heard how 1MDB Energy Holdings Limited had in 2014 taken on two massive loans totalling US$1.225 billion from Deutsche Bank in Singapore to buy back the 2012 Aabar options, but with most of these borrowings paid out to two fake Aabar companies incorporated in British Virgin Islands and Seychelles.

For the first loan of US$250 million released on May 26, 2014, 1MDB Energy Holdings had transferred US$175 million to the British Virgin Islands entity Aabar Investments PJS Limited’s account at the BSI bank in Lugano, Switzerland.

After the second loan of US$975 million was made available on September 1, 2014, 1MDB Energy Holdings had sent two payments to the Seychelles-incorporated Aabar Investments PJS Limited’s UBS bank account in Singapore – US$223.333 million on September 2, 2014 and US$457,984,607 on September 30, 2014.

Today, Azmi said he did not know why only US$175 million out of the first loan of US$250 million was paid out to the fake Aabar, and said he did not know of the difference between Aabar Investments PJS and Aabar Investments PJS Limited.

Azmi said he had only seen bank documents on the two payments to the Seychelles-based fake Aabar when shown by the Malaysian Anti-Corruption Commission (MACC) as these documents were not under 1MDB’s ownership, again reiterating that he did not know that money was being paid to the fake Aabar.

Azmi noted that the actual Aabar and the other Aabar had looked similar as they shared the same Aabar name, had the same address and were both represented by Al-Husseiny and IPIC managing director Khadem Al-Qubaisi.

A letter signed by Najib

Referred to an August 29, 2014 letter of support and approval that was signed by Najib as the then finance minister for 1MDB to take up the US$250 million loan and US$975 million loan by 1MDB, Azmi said he was never shown or informed of this letter throughout his tenure as CFO in 1MDB.

Azmi said the loan documents for the two loans had not made reference to the letter of support signed by Najib, saying: “I believe it was done outside of the management’s knowledge.”

While confirming that page five of the letter of support had carried his signature and Geh’s signature, Azmi suggested that this page may have only been added on subsequently to the letter, stating: “I verify that is my signature. However I am confident that I have never seen this letter and put down my signature on behalf of 1MDB for the purpose of this letter. It may have been appended later.”

Azmi joined 1MDB on June 1, 2012 as its chief financial officer and served for three years, with his contract renewed in 2015 until December 2017.

Azmi said he did not ask for his contract to be renewed when it ended in December 2017, and he has since then been carrying out his own business after leaving 1MDB.

The trial before High Court judge Datuk Collin Lawrence Sequerah resumes tomorrow, with former 1MDB director Tan Sri Ismee Ismail expected to take the stand as the 13th prosecution witness.

The judge had agreed with the prosecution’s suggestion that Azmi return to the witness stand at a later date to undergo examination-in-chief by lead prosecutor Datuk Seri Gopal Sri Ram and to be cross-examined when Najib’s lead defence lawyer Tan Sri Muhammad Shafee Abdullah returns from his trip abroad.