Datuk Seri Najib Razak is pictured at Kuala Lumpur High court November 11, 2021. — Picture by Ahmad Zamzahuri

KUALA LUMPUR, Nov 16 — Now-fugitive Low Taek Jho had in a 2013 email instructed then prime minister Datuk Seri Najib Razak on what to say in a meeting with 1Malaysia Development Berhad’s (1MDB) auditor KPMG, and had even told the prime minister not to have long conversations with the audit firm, the High Court heard today.

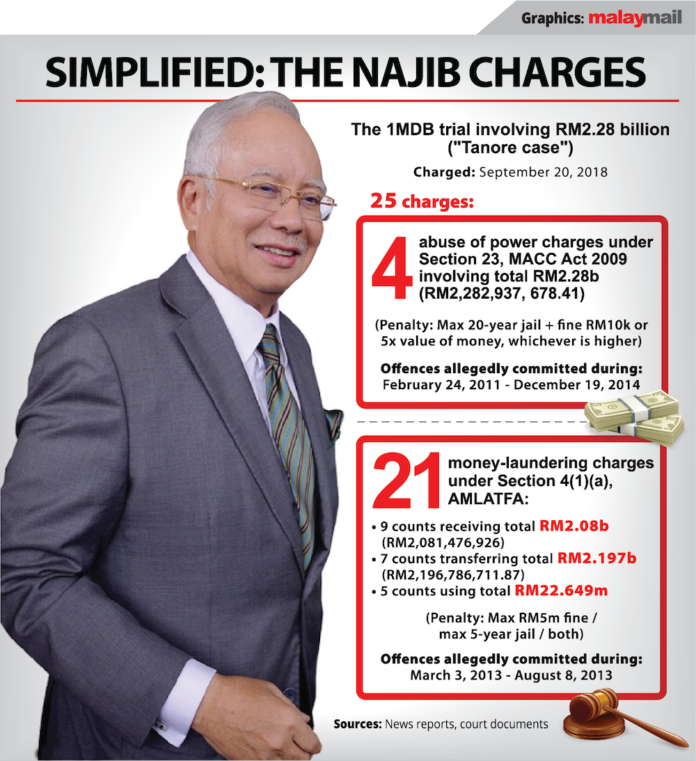

Former 1MDB chief financial officer Azmi Tahir said this while testifying as the 12th prosecution witness in Najib’s trial, where the former prime minister is facing 25 charges in relation to more than RM2 billion of allegedly misappropriated 1MDB funds.

Azmi said he had attended a December 15, 2013 meeting between KPMG and 1MDB at Najib’s house, with the auditors wanting to hear directly from Najib himself to seek explanations and find out what he knew about 1MDB’s purported overseas investment of US$2.318 billion.

Azmi said he had on the same day received an email from Low — better known as Low Taek Jho — sent out from the latter’s email account [email protected], with the email title being “Urgent: Briefing Package for YAB PM”.

Saying that Low had prepared a strategy to answer questions from KPMG, Azmi said the email from Low included the strategy for the meeting with KPMG.

Azmi said Low’s strategy was that the meeting must be attended by 1MDB board of directors’ chairman, 1MDB’s CEO and 1MDB’s CFO together with Najib, adding that Low had also directed that only Datuk Johan Idris and Ahmad Nasri Abdul Wahab would have to attend to represent KPMG.

In describing the meeting strategy in the email, Azmi said in Malay: “Jho Low instructed for Najib to not talk too much with KPMG, and must say that Najib was briefed and knows about all the investments and transactions in 1MDB and is confident with the existing documents.”

Azmi then read out an excerpt from the original email which was written in English: “As YAB PM has been briefed by the chairman of 1MDB and management of 1MDB on several occasions, YAB PM is recommended not to engage in a lengthy discussion with KPMG over the issues, although YAB PM may offer them a brief opportunity to air their views. YAB PM to state clearly he has been briefed and heard both sides, and is aware of the transactions and comfortable with them given all the facts.”

Azmi said that when he went to Najib’s house for the meeting on that day, he had seen the prime minister already having a copy of Low’s email.

Azmi said that Najib had discussed the points — outlined by Low in the email — with KPMG’s representative Johan, having also noted that only Johan attended the meeting for KPMG as other representatives from the audit firm were not allowed to enter Najib’s house.

“In this matter I found that, even though I am the CFO in 1MDB, where audit is directly under my jurisdiction, however it was Jho Low that had arranged for all documentation and talking points to Datuk Seri Najib to answer queries raised by KPMG,” Azmi said today.

By December 2013, the auditor KPMG had yet to sign off on its audit for 1MDB’s financial statement for the financial year ending March 31, 2013, as it was still pressing 1MDB for further details on the company’s alleged US$2.318 billion investment abroad.

The alleged investment by 1MDB — via six promissory notes claimed to be worth US$2.3 billion but now known to be worthless pieces of paper — were “invested” in the purported Cayman Island-based hedge fund Bridge Global Absolute Return Fund SPC, with the Singapore branch of Swiss bank BSI Bank acting as the “fund manager” of the purported investment. This is now said to be a sham investment.

Azmi said that Najib had at the December 15, 2013 meeting asked why KPMG was still raising its doubts about 1MDB’s investment’s underlying assets when BSI Bank had shown the statement for the investment, with Najib having also told KPMG to close the audit by December 31, 2013.

But with KPMG still not signing off on the 2013 audit after the meeting with Najib as it was dissatisfied with the documents and answers provided on the US$2.318 billion investment, Azmi said that 1MDB terminated this audit firm’s contract at the end of 2013 and replaced it with another “Big Four” audit firm known as Deloitte.

MORE TO COME