Former Prime Minister Datuk Seri Najib leaves the Kuala Lumpur High Court April 4, 2022. — Picture by Devan Manuel

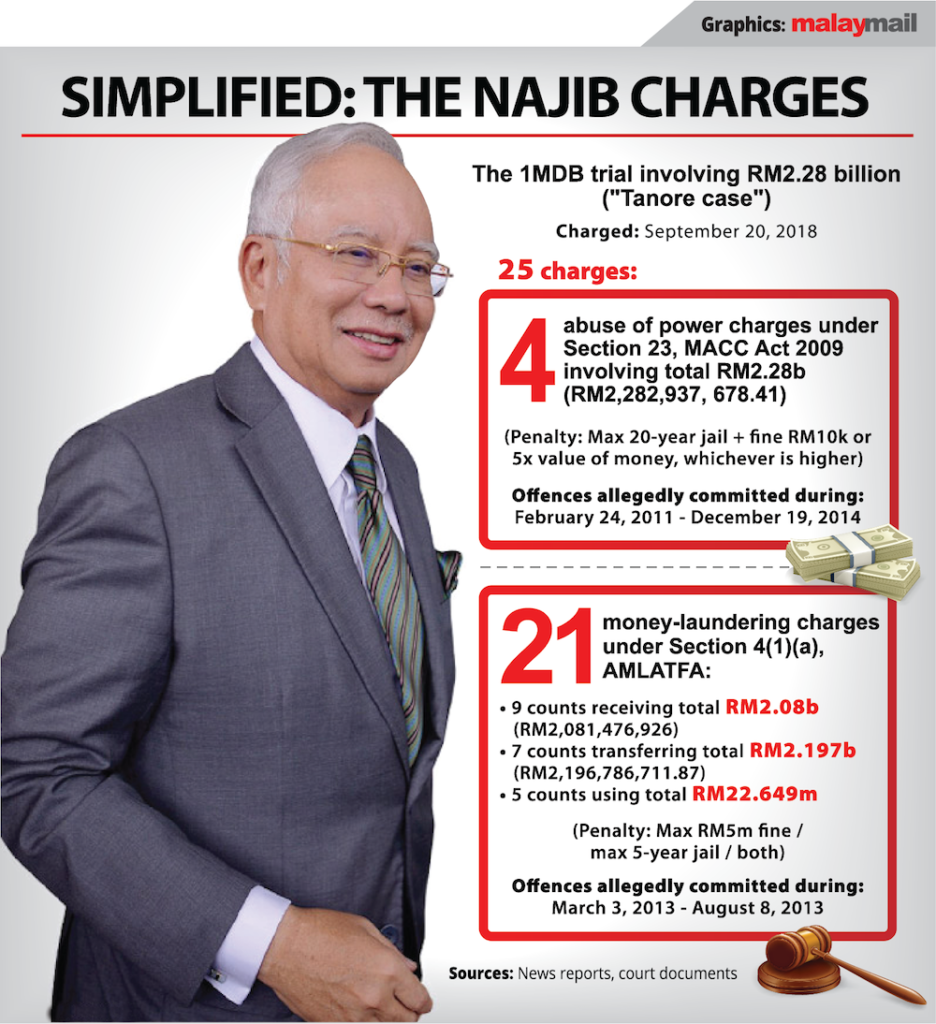

KUALA LUMPUR, April 4 — Former prime minister Datuk Seri Najib Razak’s metaphorical “fingerprints” could not be seen over the mishandling of 1Malaysia Development Berhad’s (1MDB) funds worth billions of ringgit, based on the documents shown so far by his lawyer, a witness told the High Court.

Former 1MDB director Tan Sri Ismee Ismail said this while cross-examined as the 13th prosecution witness in Najib’s trial over the misappropriation of more than RM2 billion of 1MDB funds.

Najib’s lawyer Tan Sri Muhammad Shafee Abdullah was asking Ismee about how US$1 billion (RM4.2 billion) of 1MDB’s funds went through a series of convoluted transactions, before it became six promissory notes that had a purported combined value of US$2.318 billion but were actually worthless.

Shafee today suggested that 1MDB’s management had accepted the promissory notes — or documents which promised 1MDB that it would be paid — from a company that was a “nobody” and which would not have the financial backing to pay the money to 1MDB.

Shafee: Looking at it now, with all your experience, do you find that these six promissory notes that were issued to 1MDB, were the people who arranged this, the management, were they trying to fool 1MDB itself? It’s so obvious, isn’t it? Going and accepting promissory notes of nobody of billion US dollar, it’s not a small amount. It’s almost like a joke. You understand?

Ismee: Understand.

Shafee went on to suggest that his client Najib’s figurative “fingerprints” or involvement in the mishandling of the funds was absent.

Shafee: You know the reason why I asked you this, because it goes to the heart of our defence. Did you see somewhere the fingerprints of my client with what is being done with the way the management purposely mishandled these funds, do you see the fingerprints of my client?

Ismee: With what you have shown, no.

How 1MDB ended up with the promissory notes

The US$1 billion was initially meant to be an overseas investment in 2009 by 1MDB (using money originating from a RM5 billion Islamic bond issued by 1MDB’s predecessor Terengganu Investment Authority) in exchange for shares in a joint venture company. In other words, this US$1 billion “investment” came from borrowed money or debt that 1MDB has to repay.

The form of this US$1 billion “investment” was repeatedly converted — on paper and without involving further cash being pumped in by 1MDB — into different forms, such as 1MDB giving out Islamic loans and a new set of shares, before becoming six promissory notes that were again purportedly “invested”.

Here’s how it happened — 1MDB converted its US$1 billion stake in a joint venture company into a US$1.2 billion Islamic loan to the same company and then gave out additional US$830 million in loans.

1MDB then further converted the Islamic loans into a 49 per cent stake in PetroSaudi Oil Services Ltd (PSOSL), before selling the share to Bridge Partners International Investments Limited for US$2.318 billion.

Instead of getting cash from the sale of the PSOSL shares, 1MDB’s subsidiary Brazen Sky Limited received US$2.318 billion in the form of six promissory notes.

The promissory notes were then allegedly “invested” in Cayman Island-based purported hedge fund Bridge Global Absolute Return Fund SPC with the Singapore branch of Swiss bank BSI Bank acting as the “custodian bank” or “fund manager” of the purported investment.

In short, the value eventually became inflated to be US$2.318 billion, but 1MDB did not receive cash from these transactions on paper.

The US$2.318 billion investment in Bridge Global Absolute Return Fund is now said to be a sham investment.

Former 1MDB director Tan Sri Ismee Ismail leaves the Kuala Lumpur High Court April 4, 2022. — Picture by Devan Manuel

One-month old fund

Today, Shafee highlighted that the 1MDB board of directors’ resolution and the 1MDB shareholder’s resolution both dated August 2, 2012 had decided that the proceeds of 1MDB subsidiary 1MDB International Holdings Ltd’s sale of PSOSL shares to Bridge Partners for “not less than” US$2.222,630,000 would be invested in a fund “managed by licenced fund management”.

Bridge Partners then paid for the share purchase by giving six promissory notes totalling purportedly US$2.318 billion in value, although 1MDB did not receive the payment as the promissory notes then were invested through Bridge Global.

Shafee also highlighted findings from parliamentary watchdog Public Accounts Committee’s (PAC) 2016 that 1MDB had took a high risk in deciding to invest US$2.318 billion through Bridge Global Absolute Return Fund SPC, which PAC’s report described as a “one-month company which has no licence as a fund manager or no experience to manage large funds”.

Ismee agreed to Shafee’s suggestions that the 1MDB management had ignored the board of directors’ instructions on investing the funds and appeared to have been listening to Low Taek Jho instead.

Shafee said, “This is quite a drastic non-observance of the directors’ direction, namely ‘if you have to invest the money, invest it in a licenced fund’, this one is just a one-month-old fund and it’s not even licenced”, to which Ismee agreed.

Ismee agreed that one of the directors’ circular resolution which 1MDB board of directors had signed did not specifically mention that the 1MDB management is authorised to accept payment from Bridge Partners in the form of promissory notes.

Shafee: Nothing is stated that they can accept payment by promissory notes and not cash. Here clearly the directors’ circular resolution never said ‘you can sell it but just accept promissory notes’.

Ismee: It is silent.

Shafee: And now we know this fund is only a month old. What would be the value of promissory notes without guarantee, it would be worthless because promissory notes from a fund management company without any backing.

Ismee: Yes.

Ismee also agreed with Shafee’s suggestion that the six promissory notes were not shown to the 1MDB board, further agreeing that it was ridiculous for 1MDB management to agree to accept promissory notes from an unknown entity without collateral.

Previously, former 1MDB CEO and the ninth prosecution witness in this trial, Datuk Shahrol Azral Ibrahim Halmi confirmed that he only discovered later on that the US$2.318 billion that 1MDB was trying to get back in cash had only existed on paper as worthless promissory notes, and that these documents where 1MDB was promised that it would be paid were not backed by any securities.

Najib’s 1MDB trial before High Court judge Datuk Collin Lawrence Sequerah resumes tomorrow, where Ismee is expected to continue testifying.